Dec 2, 2024 | Compliance, HR Management, HR Services, Payroll, Payroll & Taxes, Small Business

With 2025 about to arrive, small businesses should take a moment to make sure they’re ready for some HR changes that are about to happen. While some of these changes have been known about for months, other changes involve new developments. Because penalties for...

Nov 25, 2024 | Compliance, Payroll, Payroll & Taxes, Small Business

Even if you only have one employee, you are still legally required to garnish wages if you receive a court order to do so. Unfortunately, calculating the garnishment and fulfilling your legal obligation isn’t always easy. By keeping in mind a few best practices, you...

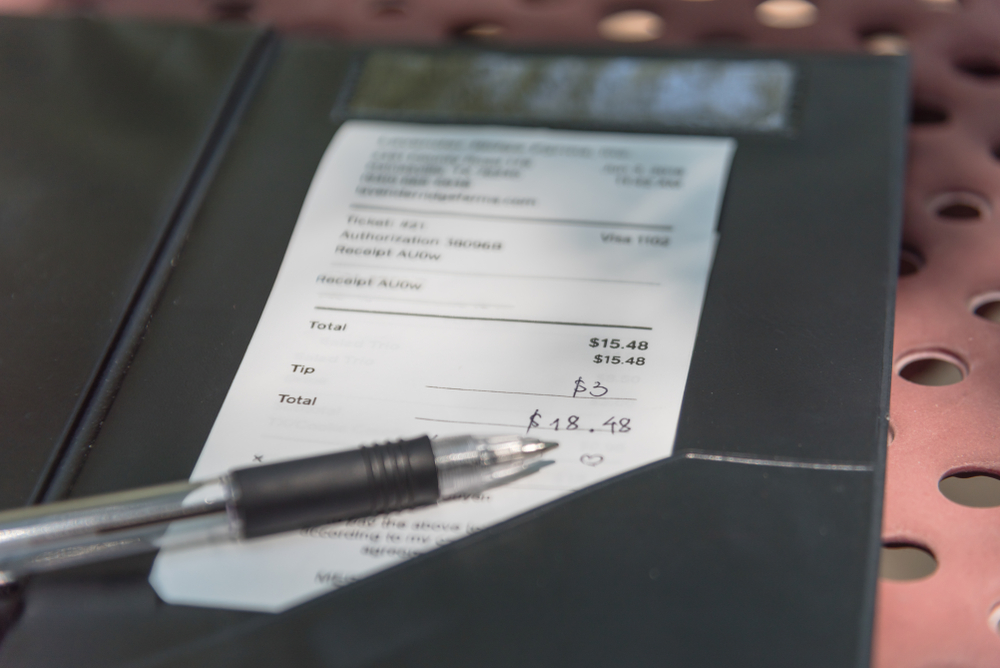

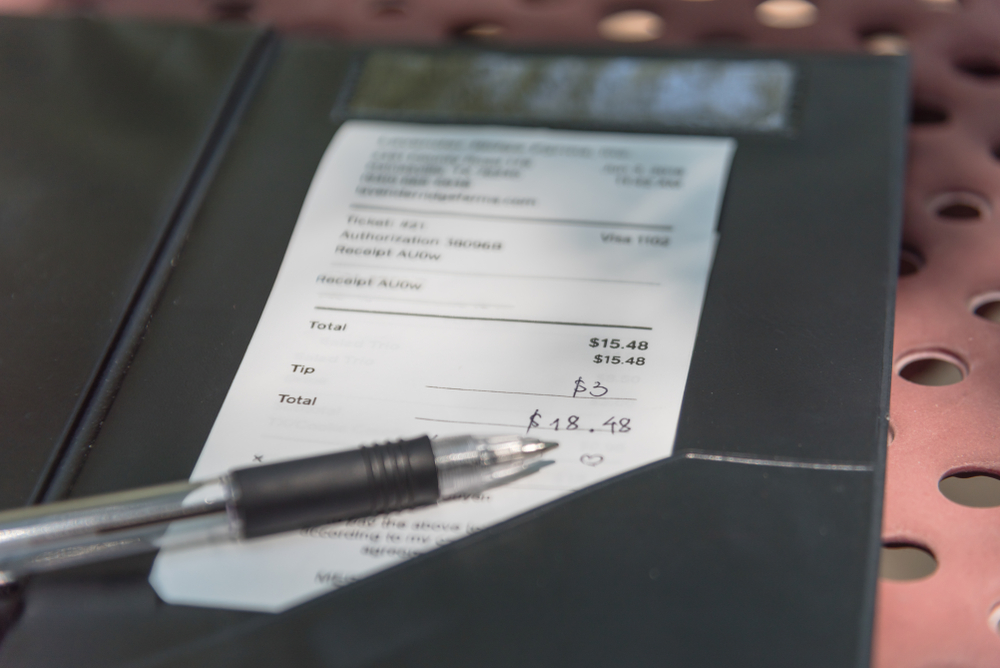

Nov 22, 2024 | Digital Workplace, Employee management, Payroll

In the bustling world of service industries, managing tips can be a significant challenge, involving the delicate balance of accuracy, compliance, and fairness. Whether it’s a restaurant or a salon, business owners need to effectively handle the complexities of...

Nov 21, 2024 | Compliance, Payroll, Payroll & Taxes, Small Business

As an employer, it is your legal obligation to garnish wages if you receive a court order to do so. If you don’t respond to the notice and take action, your business may face stiff penalties. Because different states have many variations in how they handle wage...

Nov 20, 2024 | Payroll, Payroll & Taxes

Why your New Year’s Resolution Might Include a New Payroll Solution As the new year approaches, many small business owners reflect on their operations and identify areas for improvement. One critical task often at the top of the list? Evaluating payroll systems....

Nov 20, 2024 | Benefits, Earned Wage Access, Finance, Payroll

“I think the key thing with earned wage access versus historical products that were paycheck advances or payday loans is the lending is done only against wages that are earned, not against the paycheck overall.” In episode #125 of Mission to Grow, the Asure podcast...