Feb 21, 2025 | Payroll & Taxes

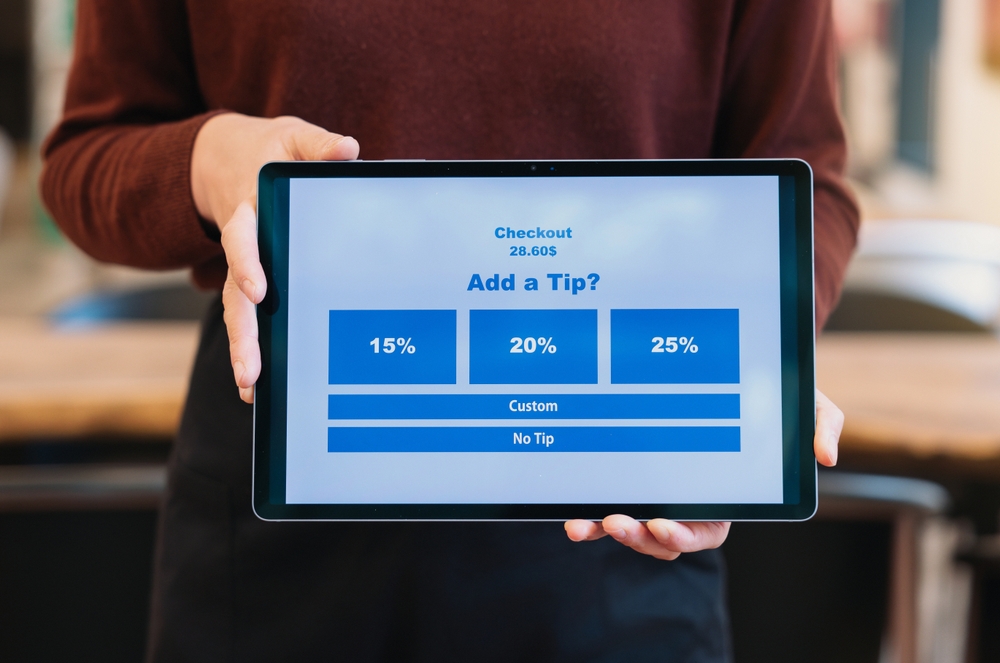

As a small business, you need all of the tax breaks you can get to boost your bottom line. If you’re a company that hires tipped workers, you may be able to spend less on your taxes by taking advantage of the Federal Insurance Contributions Act (FICA) tip credit....

Feb 18, 2025 | Benefits, Company Culture, Payroll & Taxes

When your business reaches 15 to 50 employees, you have to be strategic about competing against other organizations for workers. While you may not be able to afford high-end pay, there are still many different benefits you can use to attract workers to your company....

Feb 3, 2025 | Company Culture, Compliance, Employee management, HR Management, Payroll & Taxes, Small Business, Time & Attendance

When you’re running a small business, figuring out your payroll process is one of the first things you should do. While some employees might hang around for a few days if you hit a payroll snag, no one works for free. If you want to ensure better employee retention,...

Dec 10, 2024 | Compliance, Payroll, Payroll & Taxes, Payroll Taxes

Navigating the intricate web of compliance requirements can be a formidable challenge for California farmers, who must juggle the demands of agriculture with complex labor laws. Asure steps in as a trusted partner, simplifying the compliance process and allowing...

Dec 6, 2024 | Compliance, HR Management, HR Services, Payroll, Payroll & Taxes, Small Business

If your state legally requires small businesses to provide paid sick leave, then you are required to offer it to your employees. However, even if you aren’t required to do so, there are times when it makes sense to have paid leave as a benefit. Paid sick leave is...

Dec 5, 2024 | Compliance, Payroll, Payroll & Taxes, Small Business

Thanks to the Consumer Credit Protection Act (CCPA), employees have some relief from debtors. Back when this act was passed in 1968, states with high wage garnishment rates also had higher levels of personal bankruptcies. According to the CCPA, businesses must...