FEATURED

The Most Common Business Structures for Small Businesses

The business structure your company uses will determine how you pay taxes and your day-to-day operations. It can also impact liability, ownership, and distribution payments. By learning more about different types of business structures, you can make sure that your...

The Most Common Business Structures for Small Businesses

The business structure your company uses will determine how you pay taxes and your day-to-day operations. It can also impact liability, ownership, and distribution payments. By learning more about different types of business structures, you can make sure that your...

TRENDING

When Weather Wreaks Havoc on PTO: A Guide for Business Owners

For businesses in regions like Upstate New York, winter isn’t just a season—it’s a force to reckon with. Snowstorms, icy roads, and unpredictable weather can wreak havoc, not only on commutes but also on workplace operations. At one mid-sized firm, this reality hit...

Roofing Contractor Faces $548,801 in Penalties for OSHA Violations

A roofing contractor in Ohio is facing a substantial financial penalty of more than $548,000 for recurrently failing to ensure the safety of its employees from hazardous falls. The roofing contractor faced multiple instances of exposing workers to deadly fall hazards...

DOL Fines Restaurant $46,958 in Back Wages and Damages

Recently, the U.S. Department of Labor (DOL) took action to recover $47,000 in back wages and damages for 107 workers employed at a restaurant. This intervention came after investigations unveiled severe violations concerning minimum wage payments and overtime rates. ...

DOL Investigation Leads to Home Care Agency to Pay $630,000 in Unpaid Wages and Damages

The U.S. Department of Labor (DOL) recently secured a significant victory in a case against a home healthcare agency located in the Louisiana area. The agency and its owner were ordered by the U.S. District Court to pay a total of $630,000 in back wages and damages to...

Exploring Hidden Financing Gems for Your Small Business

Running a small or mid-sized business is no small feat. It often involves wearing multiple hats and mastering different aspects of your industry. While most small business owners excel in their field, they may not be well-versed in the complex world of finance. This...

Car Wash Faces $256,707 in Penalties for OSHA Violations

A recent U.S. Department of Labor investigation has exposed a dangerous situation at an auto services provider. The investigation revealed that workers were exposed to potentially lethal electrical hazards for over a year. This incident highlights critical safety...

DOL Investigation Recovers $419,615 in Unpaid Wages and Damages for 21 Workers of Grocery Wholesaler

A recent federal investigation has shed light on employment violations at a grocery wholesaler, emphasizing the importance of adhering to labor laws and ensuring fair compensation for workers. A grocery wholesaler, has been ordered by the U.S. Department of Labor...

Higher Enforcement Activity Expected After DOL-EEOC Partnership Agreement

By Michael H. Neifach & Thomas L. Petriccione with Jackson Lewis P.C. Body The Department of Labor (DOL) and the Equal Employment Opportunity Commission (EEOC) have announced they will be collaborating and sharing information to improve their enforcement efforts....

DOL Recovers $153,768 in Retirement Funds for 4 Employees of Environmental Company

A recent legal development highlights the importance for all businesses, particularly small and midsize enterprises, to prioritize compliance with retirement fund regulations and employee benefits. The U.S. Department of Labor (DOL) has secured a default judgment to...

DOL Sues Pipe Company for Firing Whistleblower: What Small Businesses Can Learn

In a recent case, the U.S. Department of Labor (DOL) has highlighted the importance of adhering to federal employment laws, particularly focusing on whistleblower protections. The DOL initiated a lawsuit against a pipe company, accusing the manufacturer of violating...

$545,853 in Penalties for Tile Manufacturer After DOL Investigation

An Ohio-based vinyl tile manufacturer, is under scrutiny once again for its repeated failure to ensure the safety of its workers. This recent episode has resulted in a staggering $545,853 in federal penalties after investigations by the U.S. Department of Labor...

Understanding ACA Compliance Requirements for Growing Businesses

Small and midsize businesses across the United States share common aspirations—to grow, prosper, and achieve long-term success. Yet, as these enterprises take strides toward expansion, they often encounter distinct milestones that come with their unique set of...

The Importance of HR Strategy for Small and Midsize Businesses

Small and midsize businesses (SMBs) are the backbone of the American economy, representing a significant portion of all businesses in the United States. While these enterprises often excel in their niche, they can face unique challenges in managing their human...

Dental Practice and HR Manager Directed to Pay $22,160 in Back Wages and Damages After Wrongful Termination

In a recent legal case that should serve as a stark warning to businesses, an Indiana dental practice and one of its human resources managers were ordered by Judge Richard L. Young to pay a terminated employee a total of $22,160 in back wages, liquidated damages, and...

Roofing Contractor Faces $328,143 in Penalties for OSHA Non-Compliance

In a concerning development, federal workplace safety inspectors have once again discovered serious safety violations by a roofing contractor based in Pennsylvania. This time, the violations occurred while employees were working on the roof of a commercial building....

Fostering Connection in the Virtual Workspace: Strategies for Team Bonding

The era of remote work has ushered in a new set of challenges for businesses. Among them is the need to nurture team bonds and social connections in a digital environment. A pioneer in behavioral science, offers valuable insights and techniques to address this crucial...

Cement Manufacturer Faces $62,500 in OSHA Penalties After Employee Death

In a heartbreaking incident that underscores the paramount importance of workplace safety, a recent federal investigation has unveiled a preventable tragedy that occurred at a leading cement manufacturer. The U.S. Department of Labor's Occupational Safety and Health...

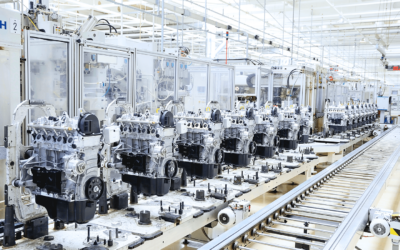

Manufacturer Fined $298,000 in OSHA Penalties: What Small Businesses Need to Know

Ensuring a safe and compliant workplace is of paramount importance for every business, regardless of size or industry. The U.S. Department of Labor (DOL) recently highlighted the consequences of failing to address safety hazards within the workplace. An engine...

DOL Investigation of Tech Consulting Business Leads to a $46,731 Fine for 401(k) Contribution Violations

The U.S. Department of Labor (DOL) has taken legal action against a technology consulting company based in Minnesota, shedding light on the critical importance of remitting employee retirement plan contributions as required by law. The DOL filed a lawsuit on August...

DOL Demands $174,751 in Back Wages from Home Healthcare Business for 50 Caregivers

In a recent case, the DOL successfully recovered $174,751 in back wages for 50 caregivers working for a home healthcare business. The violation in question involved the failure to pay overtime to these workers, underscoring the importance of compliance with employment...

How Different Sectors Approach 401(k) Retirement Planning

Retirement planning, while universally essential, manifests differently across diverse industries. Each sector, influenced by its unique challenges and opportunities, molds a distinct approach to 401(k) plans. This comprehensive exploration dives deeper into the...

Unlock your growth potential

Talk with one of experts to explore how Asure can help you reduce administrative burdens and focus on growth.