NEW

Level up your benefits

Introducing AsurePay™, an innovative new online banking solution that offers working Americans more than any other bank and helps employers with employee attraction, retention and overall efficiency.

In addition to all our FDIC-insured online banking and on-demand benefits, we provide a fast, convenient way to pay employees without the hassle of paper checks. Employees can use AsurePay to access on-demand pay or as their primary account for direct deposits.

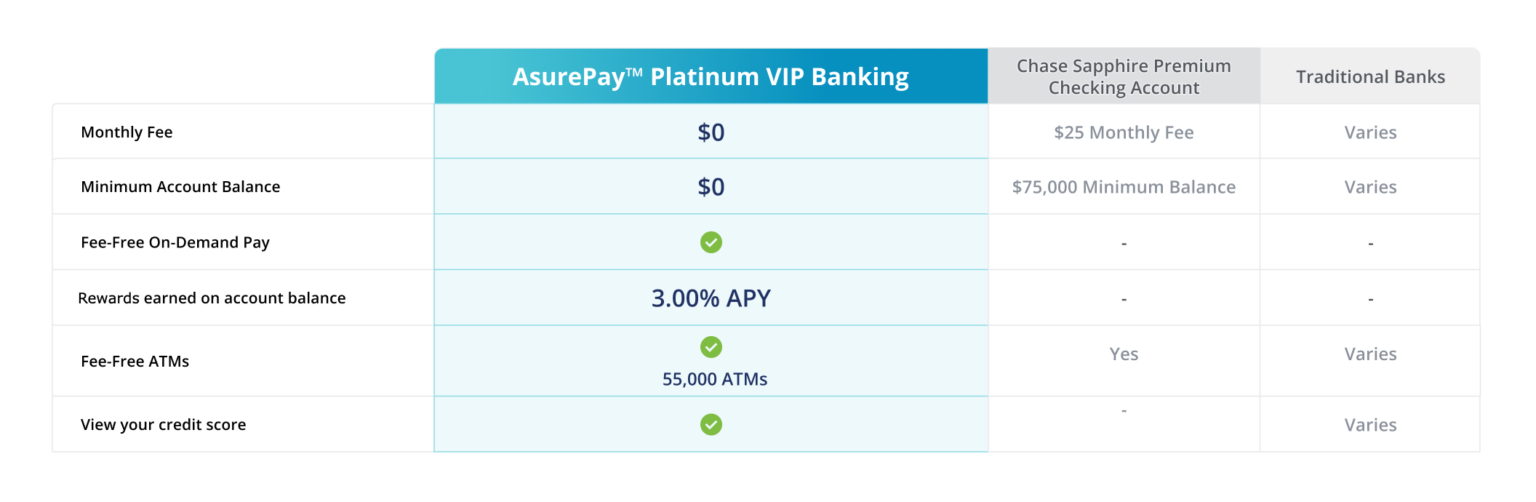

Asurepay | PAY ACCESS PLUS vs. traditional banks

AsurePay is the superior

paycard provider

AsurePay’s Platinum VIP Banking account delivers features of a traditional bank account like a VISA® debit card and an FDIC-insured account, plus added financial advantages for your employees, including rewards, fee-free on-demand pay, credit score monitoring, fee-free ATM access*** and an easy-to-use mobile app.

There are no minimum balances, monthly fees or subscriptions, and there is no cost to sign up for an account.

Don’t get left behind in the race for talent.

Major employers across the country are already offering on-demand as a key employee benefit. Stay ahead of the competition and offer your employees on-demand at zero cost. No fees, no minimums, no subscriptions, and no cost to you.

AsurePay is enabled by default to our existing customers. Simply invite your employees to register!

Employers already offering on-demand pay.

AsurePay | Platinum VIP Banking

With $0 On-Demand Pay

Other Companies

When Fees Apply.

Working Americans agree: Access to early pay is important

49%

49% of working Americans say it would be very difficult to meet current financial obligations if their next paycheck was delayed for a week.

24%

On-demand pay users aid this service improved their financial health.

60%

Make every day payday

On-demand pay is a service that allows employees to access their earned wages before their next paycheck. The service offers flexibility and convenience for employees to manage unexpected expenses, avoid late fees, and focus on their work. On-demand pay allows employees to receive their pay as they have earned it, rather than having to wait for their next scheduled pay day. The service is also referred to as earned wage access or paycheck advances.

Stand Out in a Competitive Job Market

Boost Employee Satisfaction

Offer employees convenient, on-demand access to paycheck funds, plus a rewards-earning account, and intuitive app to manage their finances at a glance.

Provide Access in

Minutes

Experience Benefits at No Cost

Download the Employer Toolkit

Frequently Asked Questions

Is AsurePay’s Platinum VIP Banking account FDIC Insured?

Yes. Every AsurePay Plantinum VIP Banking account is FDIC insured for account balances up to a maximum of $250,000.

How does AsurePay work?

Every customer has a choice of two AsurePay account types: Platinum VIP Banking or Ligthning Pay. Both account types provide paycheck advance capabilities, so long as your employer is part of the AsurePay program. Please contact your employer to request access. The AsurePay Access Plus account type also acts as an online payroll account and gives account holders 3.00% APY rewards, paid daily, and fee-free ATM access within the Allpoint network.

Why should we trust AsurePay?

AsurePay is powered by Grit Financial, Inc., a technology company with deep expertise in the the FinTech space. It holds some of the highest security protocol levels in the industry, with certifications in SOC2 and PCI compliance, along with being FDIC insured and backed by the CFSB.

What is the registration process?

Employees can go the registration website at asurepayme to sign up. Registration takes approximately 12 minutes to complete and is free of charge. Any registration questions can be directed to our CSR support team.

The AsurePay™ Visa® Prepaid Card is issued by Community Federal Saving Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Certain fees, terms, and conditions are associated with use of the AsurePay™ program. AsurePay™ is a product of Grit Financial Inc. Grit is a financial technology company, not a bank. Your funds are FDIC insured up to $250,000.

*The balance of funds available through Earned Wage Access is disclosed within the AsurePay™ app. The availability of these funds is contingent on your employment and paycheck history.

**The Annual Percentage Yield (“APY”) for the AsurePay™ Platinum Banking Account is variable and may change at any time. The disclosed APY is effective as of September 01, 2024. No minimum balance is required. Rewards will only be applied to a maximum account balance of $10,000. Rewards earned shall be computed and rounded to the nearest cent. Rewards is paid daily based on the end of day balance for the day and actual calendar days in the year.

*** See Terms for fees, such as out-of network ATM

****If you chose to receive your payroll as a direct deposit to your AsurePay card, the funds may be credited up to two (2) days prior to the scheduled payroll payment date. The actual timing of the deposit is contingent upon various factors, including but not limited to the timing of the employer’s transmission of the deposit to the financial institution and the nature of the payer responsible for the deposit.