Streamline Payroll Tax Filing

Asure’s Payroll Tax Management (APTM) software and services support

businesses of all sizes with payroll tax administration. Asure’s FlexTax™

software and services provide a compliant and confident experience with

transparency, visibility and dedicated service representatives. With over

25 years of experience, supporting thousands of multi-state entities and

billions of dollars in annual liabilities, we help reduce risk and improve

processes, so you can focus on core business strategies.

Why APTM?

Compliant

All organizations want to stay on the right side of compliance. But you don’t know what you don’t know, and the laws are always changing. Asure is an experienced Payroll Tax partner that can help you remain compliant with evolving regulations.

Scalable

The robust APTM solution is built for high-volume, complex tax filing needs. And no matter which delivery option you choose, the solution leverages the same advanced software. Select the service option that works for you now and be confident you can shift with ease as your needs change.

Flexible

Unlike other providers, Asure Payroll Tax Management is available with flexible delivery plans. Whether you

want a full-scale payroll tax filing solution or prefer to manage payroll taxes inhouse, Asure’s has an option to meet your needs and budget.

Provider Agnostic

Asure’s standalone Payroll Tax Management solution works with any payroll provider. No matter which platform you use to process payroll, you’ll enjoy a premium, streamlined experience for payroll tax management.

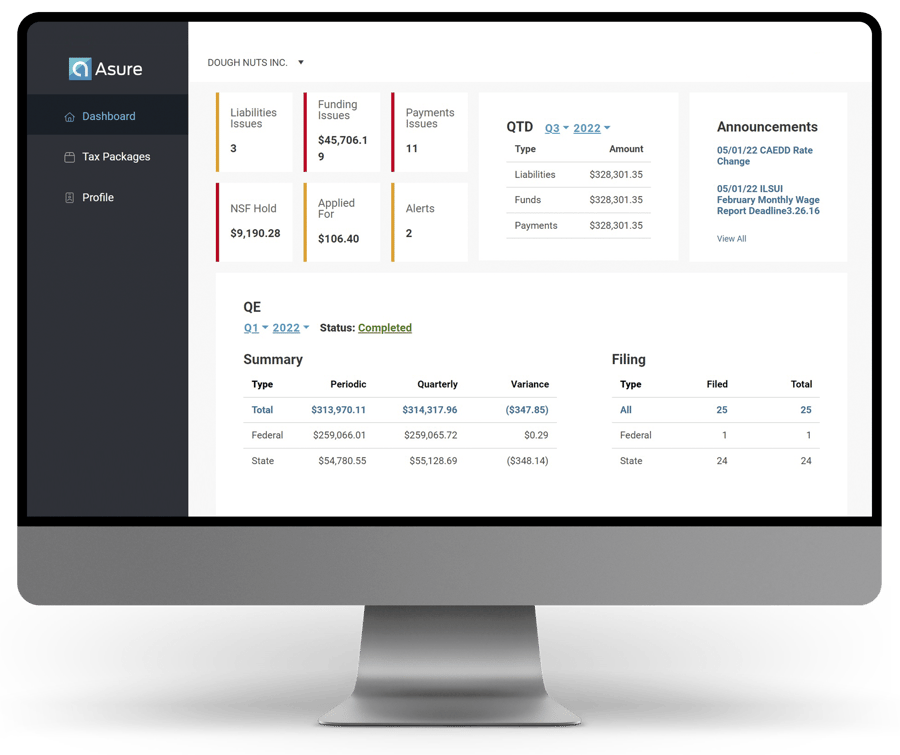

24/7 Online Tax Portal Delivers Premium Visibility

Make more informed decisions and boost efficiency with the Asure Tax Portal, a convenient web portal that provides access to historical and current-year tax data, plus all related tax information, including liabilities, deposit records, and copies of the actual tax returns. The secure, easy-to-navigate portal displays real-time status of all your tax filing reports for Federal, State, and local municipalities. This transparency is especially valuable to enterprise customers with large, geographically diverse workforces who must manage taxes across many tax jurisdictions.

Multi-State Filing Support Ensures Compliance

Managing multi-state payroll taxes can be overwhelming. With the rise of remote work and a focus on employee flexibility, many employers are facing a heightened need to process payroll taxes that cross state lines. This multi-state filing process adds to the complexity of payroll taxes , especially with changing state and local laws and an evolving workforce. Our system and our experts are equipped to handle the complexity.

Our deep expertise in the complex landscape of payroll taxes uniquely positions Asure to deliver not only a user-friendly software solution to customers, but also the experienced counsel and support of a knowledgeable team of payroll tax experts.

Pat Goepel, Asure Chairman & CEO

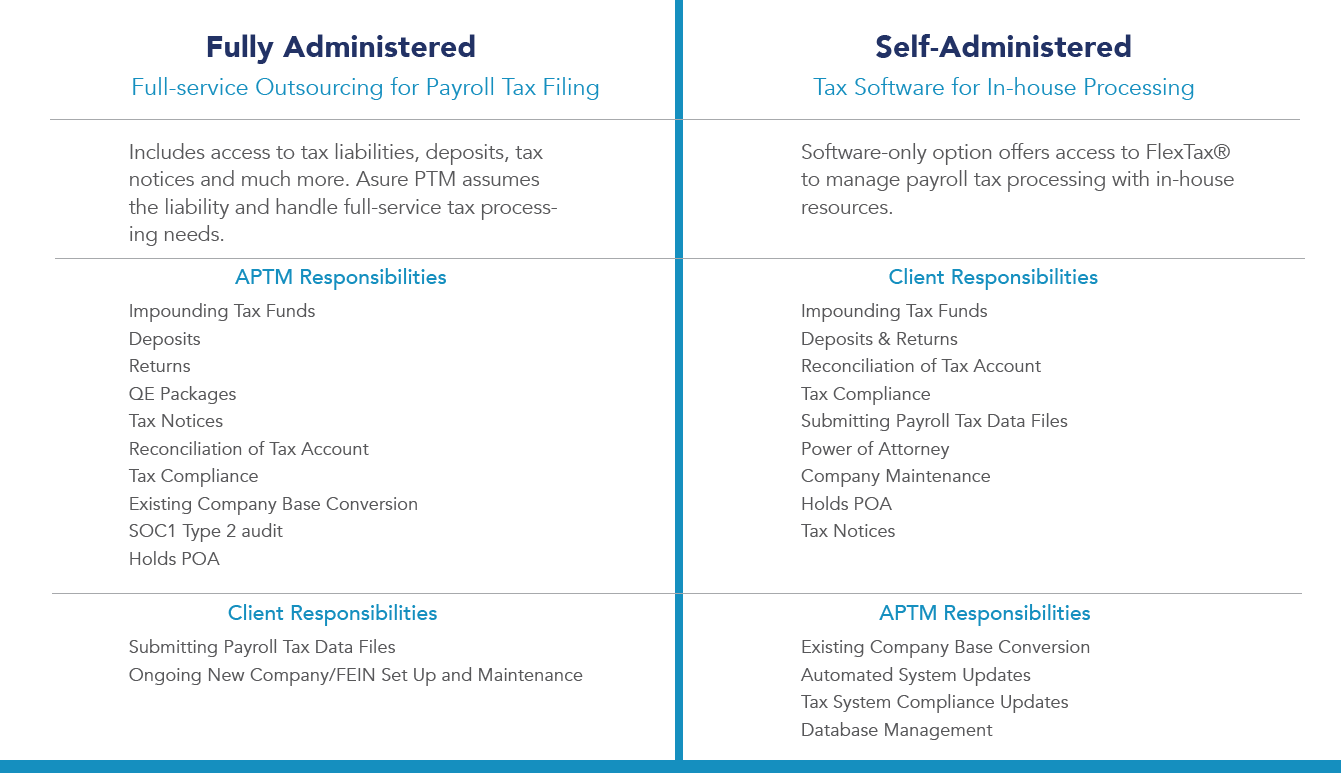

The Industry's Most Flexible Delivery Options

Whether you need a full-scale payroll tax filing outsourcing service or web-based tax software to manage in-house, we have options to meet your needs and budget, even as they change and grow. Since our service options use the same robust software, you can move between plans with ease. Our software helps you stay compliant with the flexibility of a stand-alone product that allows you to streamline your payroll tax processing, avoid risk, and grow your business.