Enhance Your Benefits Package with Retirement Savings

Small businesses in the U.S. employ 61.6 million people, nearly half (45.9%) of the entire workforce. Yet a significant percentage of these businesses do not offer retirement benefits. Here are six reasons why small businesses should add a 401(k) plan now.

1. It’s table stakes for job seekers.

Benefits are a key consideration for candidates. Offering a 401(k) can help your business compete more effectively. In fact, a 2023 survey by Charles Schwab revealed that 88% of workers consider a 401(k) plan a must-have benefit when looking for a new job.

2. It facilitates financial wellness for your employees.

As many Americans struggle with debt, inflation, medical expenses, and other financial pressures, its’ increasingly important for employers to prioritize and promote financial wellness and retirement savings options.

3. It’s a retention-boosting benefit.

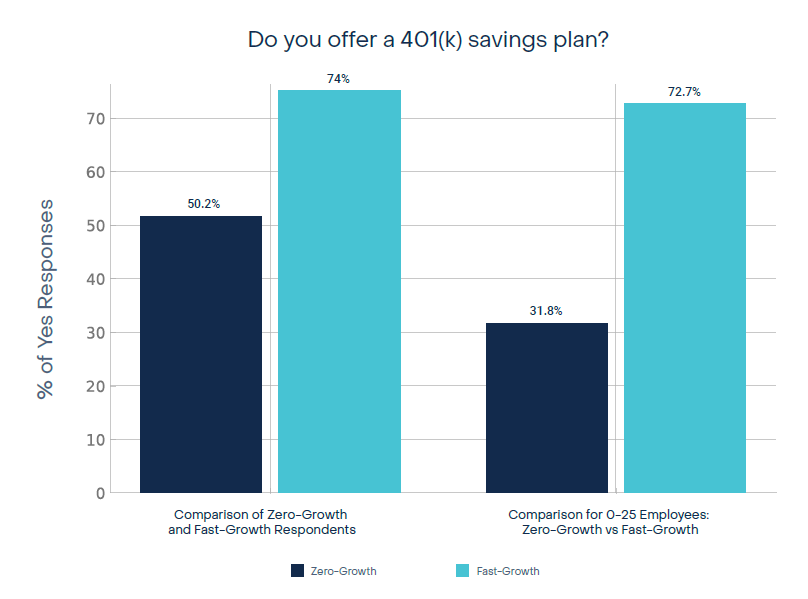

The process of hiring and onboarding is costly and time-consuming. Retain your talent with competitive benefit offerings. Simply put, a 401(k) is now a baseline expectation. If you don’t offer one, you’re at an immediate disadvantage since most say they will go elsewhere for employment. Our 2024 HR Benchmark survey revealed that 74% of fast-growing small businesses offer a 401(k) to employees. And even among small businesses with 25 or fewer employees, 73% of the fast-growing companies offer 401(k).

4. It comes with tax advantages for employers.

Employers can also take advantage of key tax benefits while simultaneously supporting their employees’ financial futures. This document is not intended to be considered legal or tax advice for your situation, but it’s a good idea to talk with your tax advisor about these benefits commonly available to businesses offering 401(k) plans.

5. It’s required by law in many states.

To combat the nation’s growing retirement savings crisis, an increasing number of states are mandating that employers provide retirement plans to employees. In fact, there are 45 states that have passed or are considering state mandates requiring employers to offer retirement plans.

6. It’s now more affordable than ever.

In the past, start-up costs have been a deterrent for small businesses considering a 401(k). Now, the recently passed SECURE 2.0 Act is changing the affordability equation for small businesses that opt to add a 401(k) plan to their benefits package.

Don’t miss out on top talent and tax savings. Connect with a payroll and 401(k) expert at Asure to explore how our made-for-small-business 401(k) plans can benefit your organization.